Summary

Prescribes standard formulas for the computation of accrued interest, dollar price and yield; sets standards for accuracy; and establishes day-counting methods.

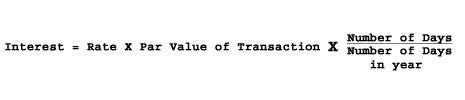

(a) Accrued Interest. Accrued interest shall be computed in accordance with the following formula:

For purposes of this formula, the "number of days" shall be deemed to be the number of days from the previous interest payment date (from the dated date, in the case of first coupons) up to, but not including, the settlement date. The "number of days" and the "number of days in year" shall be counted in accordance with the requirements of section (e) below.

(b) Interest-Bearing Securities

(i) Dollar Price. For transactions in interest-bearing securities effected on the basis of yield the resulting dollar price shall be computed in accordance with the following provisions:

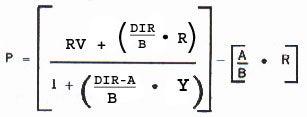

(A) Securities Paying Interest Solely at Redemption. Except as otherwise provided in this section (b), the dollar price for a transaction in a security paying interest solely at redemption shall be computed in accordance with the following formula:

For purposes of this formula the symbols shall be defined as follows:

"A" is the number of accrued days from the beginning of the interest payment period to the settlement date (computed in accordance with the provisions of section (e) below);

"B" is the number of days in the year (computed in accordance with the provisions of section (e) below);

"DIR" is the number of days from the issue date to the redemption date (computed in accordance with the provisions of section (e) below);

"P" is the dollar price of the security for each $100 par value (divided by 100);

"R" is the annual interest rate (expressed as a decimal);

"RV" is the redemption value of the security per $100 par value (divided by 100); and

"Y" is the yield price of the transaction (expressed as a decimal).

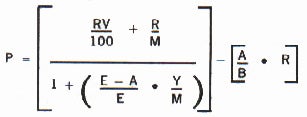

(B) Securities with Periodic Interest Payments. Except as otherwise provided in this section (b), the dollar price for a transaction in a security with periodic interest payments shall be computed as follows:

(1) for securities with one coupon period or less to redemption, the following formula shall be used:

For purposes of this formula the symbols shall be defined as follows:

"A" is the number of accrued days from the beginning of the interest payment period to the settlement date (computed in accordance with the provisions of section (e) below);

"B" is the number of days in the year (computed in accordance with the provisions of section (e) below);

"E" is the number of days in the interest payment period in which the settlement date falls (computed in accordance with the provisions of section (e) below);

"M" is the number of interest payment periods per year standard for the security involved in the transaction;

"P" is the dollar price of the security for each $100 par value (divided by 100);

"R" is the annual interest rate (expressed as a decimal);

"RV" is the redemption value of the security per $100 par value; and

"Y" is the yield price of the transaction (expressed as a decimal).

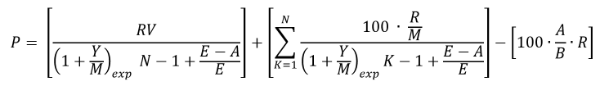

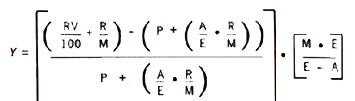

(2) for securities with more than one coupon period to redemption, the following formula shall be used:

For purposes of this formula the symbols shall be defined as follows:

"A" is the number of accrued days from beginning of the interest payment period to the settlement date (computed in accordance with the provisions of section (e) below);

"B" is the number of days in the year (computed in accordance with the provisions of section (e) below);

"E" is the number of days in the interest payment period in which the settlement date falls (computed in accordance with the provisions of section (e) below);

“M” is the number of interest payment periods per year standard for the security involved in the transaction;

"N" is the number of interest payments (expressed as a whole number) occurring between the settlement date and the redemption date, including the payment on the redemption date;

"P" is the dollar price of the security for each $100 par value;

"R" is the annual interest rate (expressed as a decimal);

"RV" is the redemption value of the security per $100 par value; and

"Y" is the yield price of the transaction (expressed as a decimal).

For purposes of this formula the symbol "exp" shall signify that the preceding value shall be raised to the power indicated by the succeeding value; for purposes of this formula the symbol "K" shall signify successively each whole number from "1" to "N" inclusive; for purposes of this formula the symbol "sigma" shall signify that the succeeding term shall be computed for each value "K" and that the results of such computations shall be summed.

(ii) Yield. Yields on interest-bearing securities shall be computed in accordance with the following provisions:

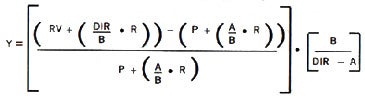

(A) Securities Paying Interest Solely at Redemption. The yield of a transaction in a security paying interest solely at redemption shall be computed in accordance with the following formula:

For purposes of this formula the symbols shall be defined as follows:

"A" is the number of accrued days from the beginning of the interest payment period to the settlement date (computed in accordance with the provisions of section (e) below);

"B" is the number of days in the year (computed in accordance with the provisions of section (e) below);

"DIR" is the number of days from the issue date to the redemption date (computed in accordance with the provisions of section (e) below);

"P" is the dollar price of the security for each $100 par value (divided by 100);

"R" is the annual interest rate (expressed as a decimal);

"RV" is the redemption value of the security per $100 par value (divided by 100); and

"Y" is the yield on the investment if the security is held to redemption (expressed as a decimal).

(B) Securities with Periodic Interest Payments. The yield of a transaction in a security with periodic interest payments shall be computed as follows:

(1) for securities with one coupon period or less to redemption, the following formula shall be used:

For purposes of this formula the symbols shall be defined as follows:

"A" is the number of accrued days from the beginning of the interest payment period to the settlement date (computed in accordance with the provisions of section (e) below);

"E" is the number of days in the interest payment period in which the settlement date falls (computed in accordance with the provisions of section (e) below);

"M" is the number of interest payment periods per year standard for the security involved in the transaction;

"P" is the dollar price of the security for each $100 par value (divided by 100);

"R" is the annual interest rate (expressed as decimal);

"RV" is the redemption value of the security per $100 par value; and

"Y" is the yield on the investment if the security is held to redemption (expressed as a decimal).

(2) for securities with more than one coupon period to redemption, the formula set forth in item (2) of subparagraph (b)(i)(B) shall be used.

(c) Discounted Securities.

(i) Dollar Price. For transactions in discounted securities, the dollar price shall be computed in accordance with the following provisions:

(A) The dollar price of a discounted security, other than a discounted security traded on a yield-equivalent basis, shall be computed in accordance with the following formula:

For purposes of this formula the symbols shall be defined as follows:

"B" is the number of days in the year (computed in accordance with the provisions of section (e) below);

"DR" is the discount rate (expressed as a decimal);

"DSM" is the number of days from the settlement date of the transaction to the maturity date (computed in accordance with the provisions of section (e) below);

"P" is the dollar price of the security for each $100 par value; and "RV" is the redemption value of the security per $100 par value.

(B) The dollar price of a discounted security traded on a yield-equivalent basis shall be computed in accordance with the formula set forth in subparagraph (b)(i)(A).

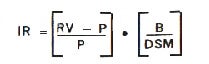

(ii) Return on Investment. The return on investment for a discounted security shall be computed in accordance with the following provisions:

(A) The return on investment for a discounted security, other than a discounted security traded on a yield-equivalent basis, shall be computed in accordance with the following formula:

For purposes of this formula the symbols shall be defined as follows:

"B" is the number of days in the year (computed in accordance with the provisions of section (e) below);

"DSM" is the number of days from the settlement date of the transaction to the maturity date (computed in accordance with the provisions of section (e) below);

"IR" is the annual return on investment if the security is held to maturity (expressed as a decimal);

"P" is the dollar price of the security for each $100 par value; and

"RV" is the redemption value of the security per $100 par value.

(B) The yield of a discounted security traded on a yield-equivalent basis shall be computed in accordance with the formula set forth in subparagraph (b)(ii)(A).

(d) Standards of Accuracy; Truncation.

(i) Intermediate Values. All values used in computations of accrued interest, yield, and dollar price shall be computed to not less than ten decimal places.

(ii) Results of Computations. Results of computations shall be presented in accordance with the following:

(A) Accrued interest shall be truncated to three decimal places, and rounded to two decimal places immediately prior to presentation of total accrued interest amount on the confirmation;

(B) Dollar prices shall be truncated to three decimal places immediately prior to presentation of dollar price on the confirmation and computation of extended principal; and

(C) Yields shall be truncated to four decimal places, and rounded to three decimal places, provided, however, that for purposes of confirmation display as required under rule G-15(a) yields accurate to the nearest .05 percentage points shall be deemed satisfactory.

Numbers shall be rounded, where required, in the following manner: if the last digit after truncation is five or above, the preceding digit shall be increased to the next highest number, and the last digit shall be discarded.

(e) Day Counting.

(i) Day Count Basis. Computations under the requirements of this rule shall be made on the basis of a thirty-day month and a three-hundred-sixty-day year, or, in the case of computations on securities paying interest solely at redemption, on the day count basis selected by the issuer of the securities.

(ii) Day Count Formula. For purposes of this rule, computations of day counts on the basis of a thirty-day month and a three-hundred-sixty-day year shall be made in accordance with the following formula.

Number of Days = (Y2 - Y1) 360 + (M2 - M1) 30 + (D2 - D1)

For purposes of this formula the symbols shall be defined as follows:

"M1" is the month of the date on which the computation period begins;

"D1" is the day of the date on which the computation period begins;

"Y1" is the year of the date on which the computation period begins;

"M2" is the month of the date on which the computation period ends;

"D2" is the day of the date on which the computation period ends; and

"Y2" is the year of the date on which the computation period ends.

For purposes of this formula, if the symbol "D2" has a value of "31," and the symbol "D1" has a value of "30" or "31," the value of the symbol "D2" shall be changed to "30." If the symbol "D1" has a value of "31," the value of the symbol "D1" shall be changed to "30." For purposes of this rule time periods shall be computed to include the day specified in the rule for the beginning of the period but not to include the day specified for the end of the period.

Rule G-33 Amendment History (since 2003)

Release No. 34-77316 (March 8, 2016), 81 FR 13426 (March 14, 2016); MSRB Notice 2016-08 (February 23, 2016)

Calculations for Securities with Periodic Interest Payments

Rule G-33 generally requires that brokers, dealers, and municipal securities dealers (“dealers”) effecting transactions in municipal securities compute yields and dollar prices in accordance with the formulas prescribed.

Prior to an amendment effective February 23, 2016, Rule G-33(b)(i)(B)(2) and, by reference, (b)(ii)(B)(2), provided that, for interest-bearing municipal securities with periodic interest payments and more than six months to redemption, dealers compute the dollar price or yield using a formula that accounted for the present value of all future coupon payments and a semi-annual payment of interest. The formula in Rule G-33(b)(i)(B)(2) now provides a more precise pricing calculation when computing yields and dollar prices on securities with periodic interest payments and more than one coupon payment to redemption. Under the amended pricing formula, rather than presuming a semi-annual interest payment, the formula requires factoring in the actual interest payment frequency of the security (e.g., monthly, quarterly or annually).

The compliance date for Rule G-33, as amended, is July 18, 2016.

Prior to July 18, 2016, a dealer will be deemed to be in compliance with Rules G-33(b)(i)(B)(2) and G-33(b)(ii)(B)(2) if calculating dollar price or yield for interest-bearing municipal securities with periodic interest payments and more than six months to redemption using the actual interest payment frequency rather than assuming a semi-annual payment. Beginning July 18, 2016, the compliance date for Rule G-33, as amended, all dealers will be required to factor in the actual interest payment frequency in calculating dollar price and yield for such securities.

Transactions in Municipal Securities with Non-Standard Features Affecting Price/Yield Calculations

Rule G-15(a) generally requires that confirmations of municipal securities transactions with customers state a dollar price and yield for the transaction. Thus, for transactions executed on a dollar price basis, a yield must be calculated; for transactions executed on a yield basis, a dollar price must be calculated. Rule G-33 provides the standard formulae for making these price/yield calculations.

It has come to the Board’s attention that certain municipal securities have been issued in recent years with features that do not fall within any of the standard formulae and assumptions in rule G-33, nor within the calculation formulae available through the available settings on existing bond calculators. For example, an issue may have first and last coupon periods that are longer than the standard coupon period of six months.

With respect to some municipal securities issues with non-standard features, industry members have agreed to certain conventions regarding price/yield calculations. For example, one of the available bond calculator setting might be used for the issue, even though the calculator setting does not provide a formula specifically designed to account for the non–standard feature. In such cases, anomalies may result in the price/yield calculations. The anomalies may appear when the calculations are compared to those using more sophisticated actuarial techniques or when the calculations are compared to those of other securities that are similar, but that do not have the non–standard feature.

The Board reminds dealers that, under rule G-17, dealers have the obligation to explain all material facts about a transaction to a customer buying or selling a municipal security. Dealers should take particular effort to ensure that customers are aware of any non-standard feature of a security. If price/yield calculations are affected by anomalies due to a non-standard feature, this may also constitute a material fact about the transaction that must be disclosed to the customer.

Price Calculation for Securities with an Initial Non-Interest Paying Period: Rule G-33

The Board has adopted a method for calculating the price of securities for which there are no scheduled interest payments for an initial period, generally for several years, after which periodic interest payments are scheduled. These securities, known by such names as "Growth and Income Securities," and "Capital Appreciation/Future Income Securities," function essentially as "zero coupon" securities for a period of time after issuance, accruing interest which is payable only upon redemption. On a certain date after issuance ("the interest commencement date"), the securities begin to accrue interest for semi-annual payment.

In March 1986, the Board published for comment a proposed method of calculating price from yield for such securities.[1] The Board received five comments on the proposed method, four expressing support for the method and one expressing no opinion. The commentators generally noted that the proposed method appeared to be accurate and could be used on bond calculators commonly available in the industry. The Board has adopted the proposed method of calculation, set forth below, as an interpretation of rule G-33 on calculations.

The general formula for calculating the price of securities with periodic interest payments is contained in rule G-33(b)(i)(B)(2). For securities with periodic payments, but with an initial non-interest paying period, this formula also is used.[2] For settlement dates occurring prior to the interest commencement date the price is computed by means of the following two-step process. First, a hypothetical price of the securities at the interest commencement date is calculated using the interest commencement date as the hypothetical settlement date,[3] the interest rate ("R" in the formula) for the securities during the interest payment period and the yield ("Y" in the formula) at which the securities are sold. This hypothetical price is computed to not less than six decimal places, and then is used as the redemption value ("RV" in the formula) in a second calculation using the G-33(b)(i)(B)(2) formula, with the interest commencement date as the redemption date, the actual settlement date for the transaction as the settlement date, and a value of zero for R, the interest rate. The resultant price, using the formula in G-33(b)(i)(B)(2), is the correct price of the securities.[4]

The price of such securities for settlement dates occurring after the interest commencement date, of course, should be calculated as for any other securities with periodic interest payments.[5]

[1] MSRB Reports, Vol. 6, No. 2 (March 1986) at 13.

[2] This interpretation is not meant to apply to securities which have a long first coupon period, but which otherwise are periodic interest paying securities.

[3] For settlement dates less than 6 months to the hypothetical redemption date, the formula in rule G-33(b)(ii)(B)(1) should be used in lieu of the formula in rule G-33(b)(ii)(B)(2).

[4] Rule G-12(c)(v)(I) and G-15(a)(i)(I) [currently codified at rule G-15(a)(i)(A)(5)(c)] require that securities be priced to the lowest of price to call, price-to-par option, or price to maturity. Thus, the redemption date used for this calculation method should be the date of an "in whole" refunding call if this would result in a lower dollar price than a computation to maturity.

[5] The formula in G-33(b)(i)(B)(1) should be used for calculations in which settlement date is 6 months or less to redemption date.

Day Counting: Day Counts on Notes

Day counting: day counts on notes. As I indicated in my letter of October 4, your September 27 letter regarding the inclusion on a customer confirmation of information with respect to the day count method used on a transaction was referred to the Board for its consideration at the December meeting. In your letter you noted that Board rule G-33 on calculations requires that

[c]omputations under the requirements of [the] rule shall be made on the basis of a thirty-day month and a three-hundred-sixty-day year, or, in the case of computations on securities paying interest solely at redemption, on the day count basis selected by the issuer of the securities.

You indicated that your bank has recently experienced problems with transactions in municipal notes ("securities paying interest solely at redemption") on which the issuer has selected a day count basis other than the traditional "30/360" basis, with the problems resulting from one party to the transaction using an incorrect day count method. You suggested that this type of problem could be partially alleviated by requiring that a municipal securities dealer selling a security on which an unusual day count method is used specify the day count method on the confirmation of the transaction.

The Board shares your concern that a failure to identify the day count method used on a particular security may subsequently cause problems in completing a transaction. Therefore, the Board believes that the parties to a transaction should exchange information at the time of trade concerning any unusual day count method used on the securities involved in the transaction. Since the party selling the securities is more likely to be aware of the unusual day count, it would be desirable that sellers take steps to ensure that they advise the contra-parties on transactions of the method to be used.

The Board does not, however, believe that it would be appropriate to require that this information be stated on the confirmation. The Board reached this determination based on its perception that the space available on the confirmation for the details of the securities description is quite limited and its belief that information regarding the day count method may not be sufficiently material to warrant its inclusion in the securities description. MSRB interpretation of December 9, 1982.

Day Counting: Securities Dated on the 15th of a Month

Day counting: securities dated on the 15th of a month. I am writing in response to your letter of May 26, 1982 in which you inquire as to the correct day count for calculation purposes on a security which is dated on the 15th of a month and pays interest on the first of a following month. In your letter you pose the example of a security dated on June 15, 1982 and paying interest on July 1, 1982, and you inquire whether the July 1, 1982 coupon on such security should have a value of 15 or 16 days of accrued interest.

As you know, Board rule G-33 provides the following formula for use on computations of day counts on securities calculated on a "30/360" day basis:

Number of days = (Y2 - Y1) 360 + (M2 - M1) 30 + (D2 - D1)

In this formula, the variables "Y1," "M1," and "D1" are defined as the year, month, and day, respectively, of the date on which the computation period begins (June 15, 1982, in your example), and "Y2," "M2," and "D2" as the year, month, and day of the date on which the computation period ends (July 1, 1982, in your example). In the situation you present, therefore, the number of days in the period would correctly be computed as follows:

Number of days = (1982 - 1982) 360 + (7 - 6) 30 + (1 - 15)

or

Number of days = (0) 360 + (1) 30 + (- 14)

or

Number of days = 0 + 30 + ( - 14)

or

Number of days = 16 days

If figured correctly, therefore, the coupon for such a period should have a value of 16 days of accrued interest. If the coupon is for a longer period of time, this particular portion of that longer period would still correctly be counted as 16 days (e.g., the day count on a coupon for the period June 15 to September 1 would correctly be figured as 76 days, consisting of 16 days for the period June 15 to July 1, and 30 days each for the months of July and August).

The error of computing the day count for such a period as 15 days apparently arises from an assumption that, on a security dated on the 15th of a month, accrued interest is owed only for the "second half" of that month. In reality, of course, the 15th of a month is not the first day of the "second half" of that month, but rather is the last day of the "first half" of that month (since a 30-day month consists of two 15-day half-months, the first half being from the 1st to the 15th, and the second half being from the 16th to the 30th). Again, it can clearly be seen that the correct day count for such a period is 16 days. MSRB interpretation of June 2, 1982.