|

Requirements for Dealers to Obtain from Their Consultants Information on

Political Contributions and Payments to Political Parties and for Dealers to

Report Such Information to the Board: Rules G-38, G-37 and G-8

|

|

Route To:

|

Amendments

Approved

The amendments require dealers to obtain from their consultants information on the consultants’ political contributions and payments to state and local political parties and to report such information to the Board on Form G-37/G-38.

|

Questions about the amendments may be directed to Ronald W. Smith, Senior Legal Associate.

On December 7, 1999, the Securities and Exchange Commission approved amendments to rules G-38, on consultants, G-37, on political contributions and prohibitions on municipal securities business, and G-8, on books and records, as well as revisions to the attachment page to Form G-37/G-38.[1] The amendments require dealers to obtain from their consultants information on the consultants’ political contributions and payments to state and local political parties and to report such information to the Board on Form G-37/G-38. The amendments will become effective on April 1, 2000.

SUMMARY OF AMENDMENTS

The amendments require a dealer to receive and report certain contribution and payment information from the consultant;[2] any partner, director, officer or employee of the consultant who communicates with an issuer to obtain municipal securities business on behalf of the dealer;[3] and any political action committee (“PAC”) controlled by the consultant or any partner, director, officer or employee of the consultant who communicates with issuers to obtain municipal securities business on behalf of the dealer. A dealer is required to obtain information from its consultants about the contributions made to issuer officials only if the consultant has had direct or indirect communication with such issuer to obtain municipal securities business on behalf of the dealer.[4] The political party payments required to be reported are limited to those made to political parties of states and political subdivisions that operate within the geographic area of the issuer with whom the consultant communicates on behalf of the dealer (e.g., city, county and state parties). The date that establishes the obligation for the collection of contribution information is the date of the consultant’s communication with the issuer to obtain municipal securities business on behalf of the dealer.

Consultant Agreement

A dealer is required to include within its Consultant Agreement[5] a statement that the consultant agrees to provide the dealer each calendar quarter with a listing of reportable political contributions to official(s) of an issuer and reportable payments to political parties of states and political subdivisions during such quarter, or a report that no reportable political contributions or reportable political party payments were made, as appropriate.[6]

“Look-Back” and “Look-Forward” Provisions

With respect to the collection of contribution and payment information, the amendments contain a six-month "look-back" provision as well as a six-month "look-forward" provision from the date of communication with an issuer. Thus, a consultant must disclose to the dealer the contributions and payments made by the consultant during the six months prior to the date of the consultant's communication with the issuer.[7] So too, if the consultant's communication with an issuer continues, any reportable contributions and payments are required to be disclosed. Once communication ceases, the consultant still must disclose contribution and payment information for six months.[8] The Board believes these provisions are important in providing information for a minimum period of one year about any consultant contributions to officials of an issuer with whom the consultant communicated on behalf of a dealer to obtain municipal securities business. This should help to identify any situations in which contributions could have influenced the awarding of municipal securities business.

A dealer’s requirement to collect contribution and payment information from its consultants ends when a Consultant Agreement has been terminated.[9] Of course, dealers should not attempt to avoid the requirements of rule G-38 by terminating a consultant relationship after directing or soliciting the consultant to make a political contribution to an issuer official after such termination. Rule G-37(d) prohibits a dealer from doing any act indirectly which would result in a violation of rule G-37 if done directly by the dealer. Thus, a dealer may violate rule G-37 by engaging in municipal securities business with an issuer after directing or soliciting any person to make a contribution to an official of such issuer.

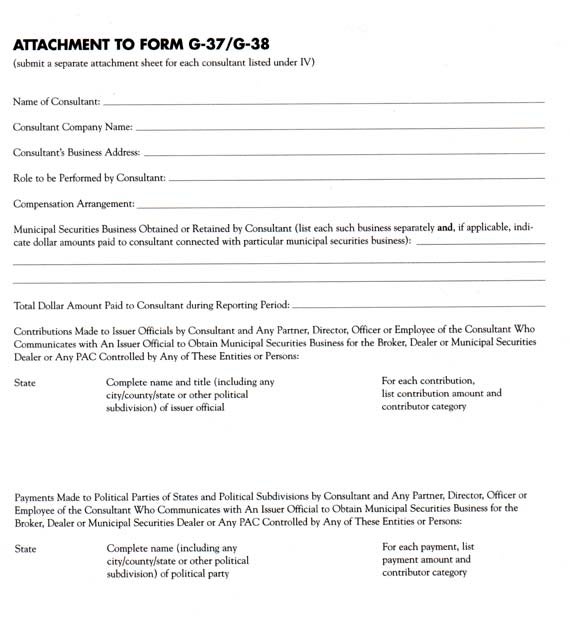

Disclosure on Form G-37/G-38

The amendments require that the information obtained by dealers concerning their consultants' contributions and payments be submitted by dealers to the Board on Form G-37/G-38.[10] The disclosures required by the amendments are reflected in the changes to Form G-37/G-38. The amendments require dealers to disclose on the attachment sheet for each consultant used by the dealer the contributions and payments covered by the rule or that the consultant reported that no such contributions or payments were made for such quarter. Furthermore, a dealer must disclose if a consultant has failed to provide it with a report concerning its contributions and payments. When completing a form, a dealer must disclose, in addition to the other required information, the calendar quarter and year of any reportable political contributions and reportable political party payments that were made prior to the calendar quarter of the form being completed (e.g., contributions and payments made in a prior quarter that are reportable as a result of the six-month look-back). “Look-back” contributions should be disclosed on the Form G-37/G-38 for the quarter in which the consultant has communicated with an issuer to obtain municipal securities business on behalf of a dealer.

As noted above, the amendments will become effective on April 1, 2000. On the reports for the second quarter of 2000 (required to be sent to the Board by July 31, 2000) dealers will be required to disclose their consultants’ reportable political contributions and reportable political party payments for the second quarter of 2000 and include, pursuant to the six-month look-back, reportable political contributions and reportable political party payments since October 1, 1999. Once a contribution or payment has been disclosed on a report, a dealer should not continue to disclose that particular contribution or payment on subsequent reports.

The attachment page to Form G-37/G-38 also has been revised to require dealers to separately identify all of the municipal securities business obtained or retained by the consultant for the dealer.

“Reasonable Efforts” Provision

The amendments contain a “reasonable efforts” provision that allows dealers to rely in good faith on information received from their consultants regarding contributions. This provision provides that a dealer will not be found to have violated rule G-38 if the dealer fails to receive from its consultants all required contribution information and thus fails to report such information to the Board if the dealer can demonstrate that it used reasonable efforts in attempting to obtain the necessary information. To avail itself of the reasonable efforts, a dealer must:

(1) state in

the Consultant Agreement that Board rules require disclosure of consultant

contributions;

(2) send quarterly reminders

to consultants of the deadline for their submissions to the dealer of

contribution information;

(3) include language in the

Consultant Agreement to the effect that: (a) the Consultant Agreement will be

terminated if, for any calendar quarter, the consultant fails to provide the

dealer with information about its reportable contributions or payments, or a

report noting that the consultant made no reportable contributions or payments,

and such failure continues up to the date to be determined by the dealer but no

later than the date by which the dealer is required to send Form G-37/G-38 to

the Board with respect to the next succeeding calendar quarter, such

termination to be effective upon the date the dealer must send its Form

G-37/G-38 to the Board, and (b) the dealer may not make any further payments to

the consultant, including payments owed for services performed prior to the

date of termination, as of the date of such termination; and

(4) enforce the Consultant

Agreement provisions described above in a full and timely manner and indicate

the reason for and date of the termination on its Form G-37/G-38 for the

applicable quarter.

The failure by a dealer to include the termination and non-payment provisions in a Consultant Agreement or to enforce any such provisions that may be contained in the Consultant Agreement, would not, in and of itself, constitute a violation of rule G-38 but would instead preclude the dealer from invoking the reasonable efforts provision as a defense against a possible violation for failing to disclose consultant contribution information, which the consultant may have withheld from the dealer.

Recordkeeping

The amendments to rule G-8 require a dealer to maintain: (1) records of each reportable political contribution; (2) records of each reportable political party payment; (3) records indicating, if applicable, that a consultant made no reportable political contributions or no reportable political party payments; and (4) a statement, if applicable, that a consultant failed to provide any report of information to the dealer concerning reportable political contributions or reportable political party payments.

Technical amendments

Finally, the amendments contain a clarifying amendment to rule G-38(b)(i)(B), and a technical amendment to rule G-37(e)(i)(D) to conform to the amendments to rule G-38.[11]

December 9, 1999

TEXT OF AMENDMENTS[12]

Rule

G-38. Consultants

(a) Definitions.

(i)-(v) No change.

(vi) The term “reportable

political contribution” means:

(A) if the

consultant has had direct or indirect communication with an issuer on behalf of

the broker, dealer or municipal securities dealer to obtain or retain municipal

securities business for such broker, dealer or municipal securities dealer, a

political contribution to an official(s) of such issuer made by any contributor

referred to in paragraph (b)(i) during the period beginning six months prior to

such communication and ending six months after such communication;

(B) the term does

not include those political contributions to official(s) of an issuer made by

any individual referred to in subparagraph (b)(i)(A) or (B) of this rule who is

entitled to vote for such official if the contributions made by such

individual, in total, are not in excess of $250 to any official of such issuer,

per election.

(vii) The term “reportable

political party payment” means:

(A) if a

political party of a state or political subdivision operates within the

geographic area of an issuer with which the consultant has had direct or

indirect communication to obtain or retain municipal securities business on

behalf of the broker, dealer or municipal securities dealer, a payment to such

party made by any contributor referred to in paragraph (b)(i) during the period

beginning six months prior to such communication and ending six months after

such communication;

(B) the term does not

include those payments to political parties of a state or political subdivision

made by any individual referred to in subparagraph (b)(i)(A) or (B) of this

rule who is entitled to vote in such state or political subdivision if the

payments made by such individual, in total, are not in excess of $250 per

political party, per year.

(viii) The term "official of such issuer" or

"official of an issuer" shall have the same

meaning as in rule G-37(g)(vi).

(b) Written Agreement.

(i) Each broker, dealer or

municipal securities dealer that uses a consultant shall evidence the

consulting arrangement by a writing setting forth, at a minimum, the name,

company, business address, role and compensation arrangement of each

such consultant ("Consultant

Agreement"). In

addition, the Consultant Agreement shall include a statement that the

consultant agrees to provide the broker, dealer or municipal securities dealer

with a list by contributor category, in writing, of any reportable political

contributions and any reportable political party payments during each calendar

quarter made by:

(A) the consultant;

(B) if the

consultant is not an individual, any partner, director, officer or employee of

the consultant who communicates with an issuer to obtain municipal securities

business on behalf of the broker, dealer or municipal securities dealer; and

(C) any

political action committee controlled by the consultant or any partner,

director, officer or employee of the consultant who communicates with an issuer

to obtain municipal securities business on behalf of the broker, dealer or

municipal securities dealer.

(ii) The

Consultant Agreement shall require that, if applicable, the consultant shall

provide to the broker, dealer or municipal securities dealer a report that no

reportable political contributions or reportable political party payments were

made during a calendar quarter.

(iii) The Consultant Agreement

shall require that the consultant provide the reportable

political

contributions and political party payments for each calendar quarter, or report

that no reportable political contributions or political party payments were

made for a particular calendar quarter, to the broker, dealer or municipal

securities dealer in sufficient time for the broker, dealer or municipal

securities dealer to meet its reporting obligations under paragraph (e) of this

rule.

(iv) Such The

Consultant Agreement must be entered into before the consultant engages in any

direct or indirect communication with an issuer on behalf of the broker, dealer

or municipal securities dealer.

(c) Information Concerning Political Contributions to

Official(s) of an Issuer and Payments to State and Local Political Parties made

by Consultants.

(i) A broker, dealer or

municipal securities dealer is required to obtain information on its

consultant’s reportable political contributions and

reportable political party payments beginning with a consultant's first direct or indirect

communication with an issuer on behalf of the broker, dealer or municipal

securities dealer to obtain or retain municipal securities business for such

broker, dealer or municipal securities dealer. The broker, dealer or municipal

securities dealer shall obtain from the consultant the information concerning

each reportable political contribution required to be recorded pursuant to rule

G-8(a)(xviii)(F) and each reportable political party payment required to be

recorded pursuant to rule G-8(a)(xviii)(G) or, if applicable, a report

indicating that the consultant made no reportable political contributions and

no reportable political party payments required to be recorded pursuant to rule

G-8(a)(xviii)(H).

(ii) The requirement to obtain

the information referred to in paragraph (c)(i) of this

rule shall end upon the termination of the Consultant

Agreement.

(iii) A broker, dealer or

municipal securities dealer will not violate this section if it fails

to receive from its consultant all required information on reportable political contributions and reportable political party payments and thus fails to report such information to the Board if the broker, dealer or municipal securities dealer can demonstrate that it used reasonable efforts in attempting to obtain the necessary information. Reasonable efforts shall include:

(A) a statement

in the Consultant Agreement that Board rules require disclosure of consultant

contributions to issuer officials and payments to state and local political

parties;

(B) the broker, dealer or

municipal securities dealer sending quarterly reminders

to its consultants of the

deadline for their submissions to the broker, dealer or municipal securities

dealer of the information concerning their reportable political contributions

and reportable political party payments;

(C) the broker,

dealer or municipal securities dealer including in the Consultant Agreement

provisions to the effect that:

(1) the Consultant Agreement will be terminated by the broker, dealer

or municipal securities dealer if, for any calendar quarter, the consultant

fails to provide the broker, dealer or municipal securities dealer with

information about its reportable political contributions or reportable

political party payments, or a report noting that the consultant made no

reportable political contributions or no reportable political party payments,

and such failure continues up to the date to be determined by the dealer, but

no later than the date by which the broker, dealer or municipal securities

dealer is required to send Form G-37/G-38 to the Board with respect to the next

succeeding calendar quarter, such termination to be effective upon the date the

broker, dealer or municipal securities dealer must send its Form G-37/G-38 to

the Board (i.e., January 31, April 30, July 31 or October 31); and

(2) no further payments, including payments owed for services performed

prior to the date of termination, shall be made to the consultant by or on

behalf of the broker, dealer or municipal securities dealer as of the date of

such termination; and

(D) the broker,

dealer or municipal securities dealer enforcing the Consultant Agreement

provisions described in paragraph (c)(iii)(C) of this rule in a full and timely

manner and indicating the reason for and date of the termination on its Form

G-37/G-38 for the applicable quarter.

(d) Disclosure to Issuers. Each broker, dealer or municipal securities dealer shall submit in writing to each issuer with which the broker, dealer or municipal securities dealer is engaging or is seeking to engage in municipal securities business, information on consulting arrangements relating to such issuer, which information shall include the name, company, business address, role and compensation arrangement of any consultant used, directly or indirectly, by the broker, dealer or municipal securities dealer to attempt to obtain or retain municipal securities business with each such issuer. Such information shall be submitted to the issuer either:

(i) – (ii) No change.

(d) (e) Disclosure to Board. Each broker,

dealer and municipal securities dealer shall send to the Board by certified or

registered mail, or some other equally prompt means that provides a record of

sending, and the Board shall make public, reports of all consultants used by

the broker, dealer or municipal securities dealer during each calendar quarter.

Two copies of the reports must be sent to the Board on Form G-37/G-38 by the

last day of the month following the end of each calendar quarter (these dates

correspond to January 31, April 30, July 31, and October 31). Such reports

shall include, for each consultant, in the prescribed format, the consultant's name, company, business

address, role, and

compensation arrangement, any

municipal securities business obtained or retained by the consultant with each

such business listed separately, and, if applicable, dollar amounts paid to the

consultant connected with particular municipal securities business. In

addition, s Such reports shall indicate the total dollar

amount of payments made to each consultant during the report period and, if

any such payments are related to the consultant's efforts on behalf of the broker, dealer or

municipal securities dealer which resulted in particular municipal securities

business, then that business and the related dollar amount of the payment must

be separately identified. In addition, such reports shall include the

following information to the extent required to be obtained during such

calendar quarter pursuant to paragraph (c)(i) of this rule:

(i)(A) the name and title

(including any city/county/state or political subdivision) of each official of

an issuer and political party receiving reportable political contributions or

reportable political party payments, listed by state; and

(B) contribution or payment

amounts made and the contributor category of the persons and entities described

in paragraphs (b)(i) of this rule; or

(ii) if applicable, a statement

that the consultant reported that no reportable political contributions or

reportable political party payments were made; or

(iii) if applicable, a statement

that the consultant failed to provide any report of information to the dealer

concerning reportable political contributions or reportable political party

payments.

Once a contribution or payment has been disclosed on a report, the dealer should not continue to disclose that particular contribution or payment on subsequent reports.

Rule G-8. Books and Records to be Made by Brokers, Dealers and Municipal

Securities Dealers

(a) Description of Books and Records Required to be Made. Except as otherwise specifically indicated in this rule, every broker, dealer and municipal securities dealer shall make and keep current the following books and records, to the extent applicable to the business of such broker, dealer or municipal securities dealer:

(i) - (xvii) No change.

(xviii) Records Concerning Consultants Pursuant to Rule G-38. Each broker, dealer and municipal securities dealer shall maintain:

(i) (A)

a listing of the name, company, business address, role and compensation

arrangement of each consultant;

(ii) (B) a copy of

each Consultant Agreement referred to in rule G-38(b);

(iii) (C) a listing

of the compensation paid in connection with each such

Consultant Agreement;

(iv) (D)

where applicable, a listing of the municipal securities business obtained or

retained through the activities of each consultant;

(v) (E) a listing of

issuers and a record of disclosures made to such issuers,

pursuant to rule G-38(c)(d),

concerning each consultant used by the broker, dealer or municipal securities

dealer to obtain or retain municipal securities business with each such issuer;

and

(vi) (F) records of each

reportable political contribution (as defined in rule G-38(a)(vi)), which

records shall include:

(1) the names, city/county and

state of residence of contributors;

(2) the names and titles

(including any city/county/state or other political

subdivision) of the recipients

of such contributions; and

(3) the amounts and dates of

such contributions;

(G) records of each reportable

political party payment (as defined in rule G-38(a)(vii)), which records shall

include:

(1) the names, city/county and

state of residence of contributors;

(2) the names and titles (including any city/county/state or other political

subdivision) of the recipients

of such payments; and

(3) the amounts and dates of

such payments;

(H) records

indicating, if applicable, that a consultant made no reportable political

contributions (as defined in rule G-38(a)(vi)) or no reportable political party

payments (as defined in rule G-38(a)(vii));

(I) a statement, if

applicable, that a consultant failed to provide any report of information to

the dealer concerning reportable political contributions or reportable

political party payments; and

(J) the date of termination

of any consultant arrangement.

(xix) No change.

(b) - (f) No change.

Rule G-37. Political Contributions and Prohibitions on Municipal Securities Business

(a) – (d) No change.

(e)(i)(A) – (C) No change.

(D) any

information required to be disclosed pursuant to section (d) (e)

of rule G-38; and

(E) No change.

(ii) – (iii) No change.

(f) – (i) No change.

* * * * * *

[1] Securities Exchange Act Release No. 42205 (December 7,

1999), 64 FR 69808 (1999).

[2] Rule G-38(a)(i) defines the term “consultant” as any person used by a dealer to obtain or retain municipal securities business through direct or indirect communication by such person with an issuer on the dealer’s behalf where the communication is undertaken by such person in exchange for, or with the understanding of receiving, payment from the dealer or any other person.

[3] A “consultant” in rule G-38 can refer to an individual or a company. For example, if an individual is a consultant, this individual would report to the dealer only his or her contributions and payments and the contributions of any PAC controlled by such individual. If the consultant is a company, the company would report its contributions and payments to the dealer, as well as those made by any partner, director, officer or employee of the consultant who communicates with issuers to obtain municipal securities business on behalf of the dealer, and any PAC controlled by the consultant or any partner, director, officer or employee of the consultant who communicates with issuers to obtain municipal securities business on behalf of the dealer.

[4] A dealer must disclose contributions with respect to those issuers from which a consultant is seeking municipal securities business on behalf of the dealer, regardless of whether contributions are going to and communications are occurring with the same or different personnel within that particular issuer.

[5] Rule G-38 requires dealers that use consultants to

evidence the consulting arrangement in writing (referred to as a “Consultant

Agreement”). The Consultant Agreement, at a minimum, must include the name,

company, role and compensation arrangement of each consultant used by the

dealer. The Consultant Agreement must be entered into before a consultant

engages in any direct or indirect communication with an issuer on the dealer’s

behalf.

[6] The de minimis exception for contributions to official(s) of an issuer provides that a consultant need not provide to a dealer information about contributions of the consultant (but only if the consultant is an individual) or by any partner, director, officer or employee of the consultant (if the consultant is a company) who communicates with issuers to obtain municipal securities business on behalf of the dealer made to any official of an issuer for whom such individual is entitled to vote if such individual’s contributions, in total, are not in excess of $250 to each official of such issuer, per election. Similarly, the de minimis exception for payments provides that a consultant need not provide to a dealer information about payments of the consultant to political parties of a state or political subdivision (but only if the consultant is an individual) or by any partner, director, officer or employee of the consultant (if the consultant is a company) who communicates with issuers to obtain municipal securities business on behalf of the dealer and who is entitled to vote in such state or political subdivision if the payments made by the individual, in total, are not in excess of $250 per political party, per year.

[7] Such contributions and payments become reportable in the calendar quarter in which the consultant first communicates with the issuer. Thus, for the quarter in which a consultant first communicates with the issuer, the dealer would be required to collect from the consultant its reportable political contributions and reportable political party payments for such quarter and, pursuant to the six-month look-back, for the six-month period preceding such first communication.

[8] Contributions and payments made simultaneously with or after the consultant’s first communication with the issuer are reportable in the calendar quarter in which they are made.

[9] A dealer that terminates a Consultant Agreement would of course be obligated to obtain information regarding contributions and payments made up to the date of termination.

[10] The amendments also require dealers to report the consultant’s business address on Form G-37/G-38.

[11] Rule G-8(a)(xviii) was also amended to require a dealer to maintain a record of a consultant’s business address.

[12] Underlining indicates new language; strikethrough denotes

deletions.