Contact: Bruce Hall, Director, Communications

202-838-1500

bhall@msrb.org

MSRB ANNOUNCES MEMBERS OF 2024 ADVISORY GROUPS

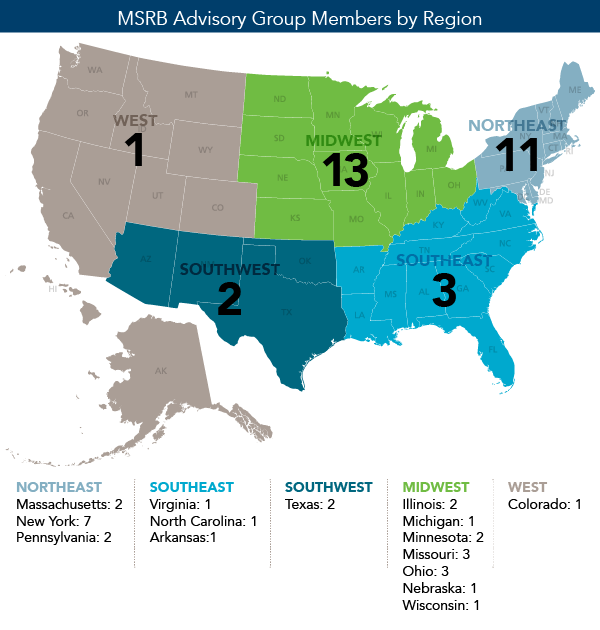

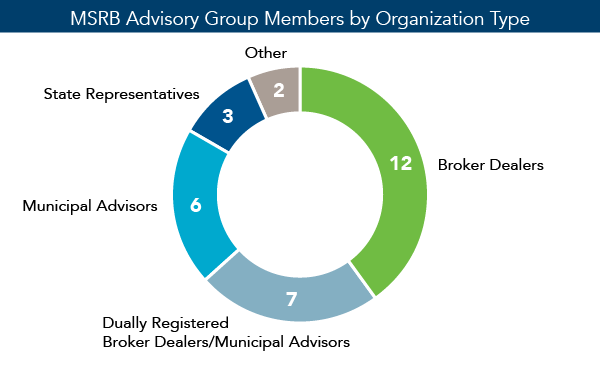

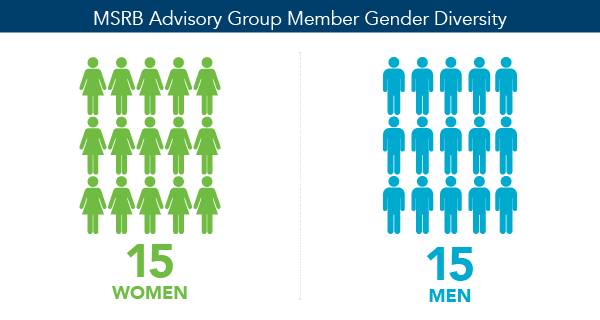

Washington, DC – The Municipal Securities Rulemaking Board (MSRB) today announced the members of its advisory groups. In all, 30 experienced market professionals will share their municipal market and regulatory perspectives while serving on the Compliance Advisory Group (CAG) and Municipal Fund Securities Advisory Group (MFSAG).

For the seventh consecutive year, CAG will inform the MSRB’s compliance initiatives by providing feedback on compliance resources and tools to enhance dealers’ and municipal advisors’ understanding of MSRB rules and areas where compliance clarification and assistance may be warranted. “We are fortunate that such a diverse class of municipal market participants have volunteered their time and expertise to help inform the MSRB’s important work,” said Liz Sweeney, Board member and FY 2024 CAG Chair. “It is especially helpful that issues of particular interest and concern to small firms can be effectively communicated to the MSRB by hearing directly from CAG’s small firm representatives, in addition to the MSRB’s other outreach and engagement channels with smaller regulated entities.”

Reinstated in FY 2024 following a gap year, MFSAG will provide input on industry practices, guidance and investor education related to 529 savings plans and Achieving a Better Life Experience Act of 2014 (ABLE) programs. “For MFSAG, we are pleased to welcome market participants operating within the 529 and ABLE spaces to lend their experience and perspectives on current market practices — such thoughtful discussions will inform the MSRB’s work as it explores regulatory efforts within this market,” said David Belton, Board member and FY 2024 MFSAG Chair.

|

Image

|

Image

|

Image

|

Click images above for larger view

The advisory groups meet multiple times a year to offer expertise on various market-related issues. Members serve staggered two-year terms to maintain continuity. Both advisory groups will continue to be a resource to the MSRB in fostering a dialogue and working collaboratively with market participants.

Advisory group members for the current fiscal year are listed below.

Compliance Advisory Group

Returning Members

- Elyse Andrews, Financial Analyst & Chief Compliance Officer, Fiscal Advisors & Marketing, Inc.

- Alyssa Glaser, Managing Director, Baker Tilly Municipal Advisors, LLC

- Richard Hartke, Partner, Institutional Sales & Trading, CINCAP Investment Group, LLC

- Heidi Kalisch, Vice President & Senior Compliance Manager, Hilltop Securities Inc.

- Heather Melzer, Vice President & Compliance Program Manager, Robert W. Baird & Co. Inc.

- Pamela Mobley, President & CEO, The RSI Group, LLC

- Joshua Spurlock, Assistant Vice President & Lead Compliance Officer, Corporate and Investment Banking, Wells Fargo Securities LLC

- Sydney Teixeira, Compliance Counsel, Capital Markets and Operations Compliance, Edward Jones

New Members

- Stephen S. Berkeley, Chief Compliance Officer and Regulatory Counsel, Loop Capital LLC

- Jason Ferguson, Director, Municipal Compliance, Barclays Capital Inc.

- George Hinchcliff, Director, FIC Compliance Advisory, RBC Capital Markets

- Lee Maverick, Chief Compliance Officer, Samco Capital Markets, Inc.

- Rebekah Most, Vice President, Municipal Underwriting Operations Manager, D.A. Davidson & Co.

- Richard Porreca, Fixed Income Compliance Manager, Janney Montgomery Scott, LLC

- Michael G. Sudsina, President, Chief Executive Officer, and Chief Compliance Officer, Sudsina & Associates, LLC

Municipal Fund Securities Advisory Group:

- Kristia Adrian, Executive Director, National 529 Specialist, JP Morgan Asset Management

- Rachel Biar, Assistant State Treasurer, Nebraska

- Mary Anne Busse, Managing Director, Great Disclosure LLC

- Paul Curley, CFA, Director of Savings Research, ISS Market Intelligence

- Anthony Durkan, Vice President, Head of 529 Relationship Management, Fidelity Investments

- Andrea Feirstein, Managing Director, AKF Consulting Group

- Sean Flynn, Chief Compliance Officer, TIAA-CREF Tuition Financing, Inc.

- William Mastrodicasa, Managing Director, First Public, LLC

- John Mitchell, Director of College Savings, Illinois State Treasurer's Office

- Stephen Jobe, Senior Vice President 529 & ABLE, Vestwell State Savings, LLC

- Richard J Polimeni, Director, Head of Education Savings Programs, Bank of America

- Risa Schulz, Executive Director, Wealth Management, Morgan Stanley

- Audrey Syatt, Associate General Counsel, Ascensus

- Brea Tabernik, Product Leader, Managed Investments, Edward Jones

- Sherri Wyatt, Chief Compliance Officer, Virginia529