Making America’s Communities Stronger One Bond at a Time

Get to Know MSRB's Board of Directors

by Jacob Lesser, General Counsel

MSRB recently announced that it is soliciting applications for four positions on its Board of Directors for the 2027 fiscal year. Selected candidates will be elected to four-year terms beginning October 1, 2026, where they will have the opportunity to advance MSRB’s mission to protect investors, issuers, and the public interest.

But before we launch into what’s next, we thought it would be helpful to provide an overview of who makes up MSRB’s Board of Directors and how our process ensures strong corporate governance that brings the perspectives and industry expertise that shape our work to promote a fair and efficient municipal securities market.

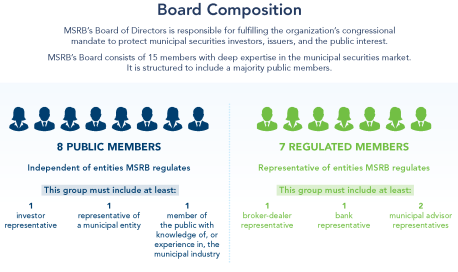

MSRB's Board is composed of 15 members who are seasoned experts with over 300 years of collective experience in the municipal securities market. These professionals hail from all corners of the market, including banks, broker-dealers, municipal advisors, issuers and investors.

The Board maintains a balance between public and industry representation, with eight members who are independent of the entities the MSRB regulates (including at least one investor, one issuer, and one member of the public with knowledge of or experience in the municipal securities industry) and seven members who are representative of the entities regulated by MSRB (including at least one bank representative, one broker-dealer representative, and two municipal advisors). To ensure independence, public members must not have been associated with a regulated firm for at least five years and must have no other relationship with a regulated entity that could affect their independent judgment and decision making. Board terms last four years and are staggered for continuity of representation on the Board.

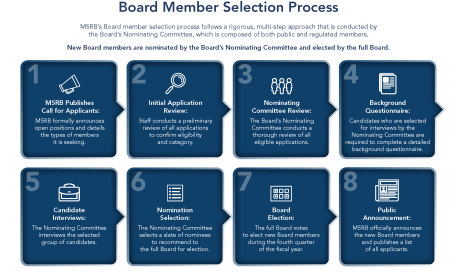

Anyone with relevant knowledge and experience can apply to be on MSRB’s Board. Once applications are submitted, MSRB staff conducts an initial review to confirm each applicant’s eligibility as a public or regulated representative and ensure that all necessary information has been provided in the application. Read the FAQs for additional information on Board membership categories and eligibility.

The Board's Nominating Committee then reviews all applications and selects candidates for interviews during a rigorous, multi-step process. Additional screening, including the Board Member Candidate Questionnaire, is required for applicants who are interviewed. Candidates from varied backgrounds that meet Board composition requirements are evaluated based on expertise, organization type and size, and geographic location, and are selected according to the Board’s evolving needs.

After completion of the interview process, the Nominating Committee nominates selected candidates to the full Board of Directors for election, and the nominating process is concluded by September 30. Upon completion of the process, the new Board members are publicly announced, and the names of all applicants are published on MSRB’s website. Individuals not selected are encouraged to apply again, as the Board’s needs can change each year.

While this is a lengthy and time-intensive process, it is one that merits such diligence, as MSRB remains committed to strong corporate governance as we work to give America the confidence to invest in its communities.

Learn more about MSRB’s Board.

Get to know MSRB’s current Board members.

Apply to serve on MSRB’s Board

MSRB: 50 Years of Protecting the Market

by Ernesto Lanza, MSRB Chief Regulatory and Policy Officer

October 2025

For 50 years, MSRB has safeguarded America’s $4 trillion municipal securities market, the primary source of capital for tens of thousands of state and local issuers, by writing the “rules of the road” to protect investors, issuers and the public interest. Congress created MSRB in 1975 to ensure that every investor, from retirees buying a single local bond to institutions buying large amounts of major bond issues, could participate in a fair and efficient market. Congress expanded MSRB’s mandate in 2010 to include the protection of states and municipalities offering municipal bonds to the public. While the MSRB Rulebook may be the most visible aspect of our work, each rule is predicated on the protection of investors and issuers and ensures MSRB serves its congressional mandate.

Investor Protection

MSRB’s investor protection starts with a robust rulebook and detailed rulemaking process that sets high standards for broker-dealers and municipal advisors. The rules require fair dealing (Rule G-17) and suitable recommendations (Rule G-19), fair pricing (Rule G-30), written confirmations and mark-up disclosure (Rule G-15), and best execution (Rule G-18), and are enforced by the SEC and FINRA. These rules are not static; they evolve through a rigorous rulemaking process informed by market data, stakeholder input and regulatory coordination.

Complementing MSRB’s rules are tools like the Electronic Municipal Market Access (EMMA) website, which provides market data free of charge—enhancing market transparency. EMMA allows investors to verify recommendations, benchmark prices, and monitor their holdings using the same information available to industry professionals. MSRB’s online Education Center further empowers investors and issuers by offering resources.

Issuer Protection

MSRB also serves a key role in safeguarding municipal entities and obligated persons and others who issue or support municipal securities. Since 2010, MSRB has regulated municipal advisors, ensuring they provide objective guidance to state and local governments. Additional rules and protections exist for public pension plans, 529 college savings programs, ABLE accounts, and other municipal fund securities. MSRB provides protection through rules promoting fair, transparent and efficient transactions, and by disseminating market data to support informed decision-making.

As with investors, EMMA and MSRB’s Education Center are additional ways in which MSRB protects this important group of market participants—aiding market transparency and providing yet another resource in the education space.

As we mark MSRB’s 50th anniversary, we remain resolute in continuously evaluating and modernizing our regulatory framework. Drawing on market expertise, stakeholder feedback, and close coordination with fellow regulators, we are providing investors and issuers with the confidence to invest in their communities for decades to come.

Anatomy of MSRB’s Rulemaking Process

by Ernesto Lanza, MSRB Chief Regulatory and Policy Officer

October 2025

The municipal securities market has changed significantly since MSRB was established 50 years ago—and our rulemaking process has remained steady, providing a stable foundation to adapt MSRB rules to meet the market’s evolving needs. While the market has grown more complex, MSRB’s commitment to transparent, inclusive, and economically sound rulemaking remains.

While the rule writing process may seem complicated, we want to ensure all market participants understand how the process works and how stakeholders inform our work and decisioning. At the end of the day, MSRB’s north star continues to be our congressional mandate to protect investors, issuers and the public interest. Together with our technology and data, MSRB’s rules contribute to this critically important mission that ensures a fair and efficient municipal market, which benefits our nation’s communities.

Each MSRB rule starts by identifying a market need, often aided by collaboration with stakeholders and fellow regulators, and assessing whether regulatory action is the best path forward. In some cases, MSRB may issue a concept release or Request for Information to explore an issue more broadly and receive valuable and varied stakeholder feedback prior to drafting a proposal.

When rulemaking is warranted, MSRB begins drafting new or amended rules to address the market need. This phase is informed by a formal economic analysis to assess the potential implications of possible approaches to addressing market issues. Depending on the significance of the change, MSRB will publish a Request for Comment so those we are congressionally mandated to protect—investors, issuers and the public—as well as those we regulate—dealers and municipal advisors—have an opportunity to provide feedback. This feedback is crucial to ensuring that our rules are tailored and effective. It also helps us determine whether deeper economic analysis or further Requests for Comment are needed before proceeding, or whether no rulemaking should be undertaken.

Once MSRB concludes that a proposed rule appropriately balances competing considerations and represents the best approach to address the underlying issue, it is filed with the Securities and Exchange Commission (SEC). The SEC will have a comment period for our proposed rules, providing yet another opportunity for the industry and public to provide feedback. In general, a rule does not take effect until the SEC approves it. If the rule is not immediately effective, MSRB will set an effective date, taking into consideration the time, cost, and labor that may be required to comply. Read more about each step of the process for additional detail.

While it is easy to assume the rulemaking process is over when the rule takes effect, MSRB’s role doesn’t end there. We monitor the market, engage with stakeholders and evaluate whether our rules are achieving their intended purpose. This ongoing review process helps us adapt to new developments, ensure our rulebook reflects current market practices and protects investors, issuers and the public interest.

Get to Know the Muni Market

by John Bagley, MSRB Chief Market Structure Officer

August 2025

As MSRB celebrates 50 years of serving its congressional mandate to protect investors, issuers and the public interest, we wanted to shine a light on the vital and expanding role of municipal securities in helping America’s communities thrive.

States, cities, counties and other municipalities rely on municipal bonds to build critical infrastructure, like roads, transit systems, schools, hospitals, and much more. But how vast and vital is this market?

Tens of thousands of public entities issue bonds in the $4 trillion municipal securities market. There are approximately 1 million municipal bonds outstanding, and the total amount of bonds issued every year has grown steadily, reaching a record of $513 billion in 2024. By comparison, the corporate bond market amounts to about $11 trillion, with approximately 6,600 different issuers and 60,000 unique bonds outstanding.1

Investor interest in municipal bonds has also grown, especially since 2022, when interest rates started to rise from historic lows. With tax-exempt yields ranging from 2.5% for 1-year maturities to 4.5% for 30-year maturities as of the end of June 2025, investor trading in these securities has grown significantly. The year 2024 was the third consecutive year for record trade volume, and this record-breaking pace has continued into 2025.

Individuals are by far the largest group of investors in this market. Millions of them own municipal bonds either directly, through separately managed accounts, or through mutual funds and exchange traded funds (ETFs). Together they hold nearly 66% of outstanding securities, 45% directly and approximately 21% through mutual funds and ETFs.

Along with writing the rules of the road for the municipal securities market, MSRB operates the Electronic Municipal Market Access (EMMA®) website, the central repository for municipal securities data and disclosure documents, providing data and information for free to investors and all market participants. Here are some highlights:

- Visit the EMMA website to view trade data on individual securities and issuer disclosures.

- Visit EMMA’s Market Statistics page for aggregate information on trades, issuance and continuing disclosures.

- Visit EMMA’s Yield Curves and Indices page for daily and historical yield curves and indices from third-party providers.

MSRB staff analyze the data collected to identify trends that inform regulatory decision making and publish research, data reports and education content that allow policymakers, market participants and the public to better understand the municipal securities market. These data and research reports are available for free on MSRB.org. We encourage you to explore and learn more about this impactful market by visiting both EMMA and MSRB’s Data and Research Publications page.

1 Sources: Board of Governors of the Federal Reserve System, LSEG and Bloomberg Financial L.P.

Get to Know MSRB: How Our Mandate and Model Shapes Our Work

by Mark Kim, MSRB CEO

June 2025

The Municipal Securities Rulemaking Board (MSRB) is a private self-regulatory organization (SRO) authorized by Congress to safeguard the integrity of the $4 trillion municipal securities market. For 50 years, MSRB has remained unwavering in its commitment to its congressional mandate: to protect investors, issuers, and the public interest by fostering a fair and efficient municipal market.

Communities nationwide rely on the municipal securities market to fund critical infrastructure and services that make life better for all Americans. From the water we drink to the transit systems that get us to where we need to be, municipal bonds are hard at work making this nation stronger, one bond at a time.

Our congressional mandate is one that MSRB serves with immense pride and conviction as it shapes the very foundations of America’s communities, helping them thrive for generations to come. Fifty years since our founding, we remain driven solely by this mandate, operating as an independent, non-partisan SRO within the statutory framework of the Securities Exchange Act of 1934.

Overseen by the Securities and Exchange Commission (SEC), MSRB writes the "rules of the road" for industry professionals, and all its rules must be filed with the SEC before they become effective. MSRB also provides transparency of the municipal securities market for the public and all market participants by operating the Electronic Municipal Market Access (EMMA®) website. EMMA is the central data repository that provides free access to municipal securities data and disclosure documents.

Several key factors reinforce MSRB’s independence and singular focus as an SRO. Unlike government agencies, MSRB is financed by the industry it oversees, not taxpayer dollars. Our board of directors is composed of industry experts whose extensive knowledge spans the entire municipal securities market. In addition, a majority of our board consists of public members who are not associated with entities regulated by the MSRB, which helps ensure that the MSRB serves the public interest. As we celebrate our 50th anniversary, MSRB remains committed to serving its mandate and mission through the rules we write, the market transparency and reporting systems we operate and the data and information we bring to the market. We are proud to give America the confidence to invest in its communities and look forward to continuing to do so over the next 50 years. Stay tuned for more posts that will help you get to know MSRB.

50 Years of Protecting Investors, Issuers and the Public Interest

by Mark Kim, MSRB CEO

February 2025

Communities across the nation have long issued municipal bonds to raise capital to build public infrastructure. From the water we drink, to the roads and bridges that get us where we need to be, to the schools that educate our children and the hospitals that care for our sick, everywhere you look, municipal bonds are improving our quality of life. For 50 years, the Municipal Securities Rulemaking Board (MSRB) has been working hard to ensure the integrity of the $4 trillion municipal bond market that gives America the confidence to invest in its communities.

In 1975, Congress established MSRB as an independent, private self-regulatory organization (SRO) to protect investors, issuers and the public interest by ensuring a fair and efficient municipal securities market. As an SRO, we are governed by a board of directors that includes both public and regulated members, all of whom have extensive market expertise. This broad representation ensures MSRB has the knowledge and experience necessary to address a rapidly evolving market through informed regulation that safeguards the interests of the investors and issuers we are responsible for protecting.

As MSRB celebrates its 50th anniversary in 2025, we remain resolute in upholding our congressional mandate through market regulation, market transparency and market integrity. We are advancing MSRB’s mission by:

- Establishing rules for the municipal securities market and re-examining existing ones to ensure they continue to effectively carry out their intended purposes and to foster market innovation and competition.

- Operating technology systems that are essential to a fair and orderly market such as our Electronic Municipal Market Access (EMMA®) website—the official repository for municipal securities data and documents—and enhancing market transparency by making this information available to the public for free.

- Promoting the integrity of this market by adapting to a rapidly evolving market structure driven by emerging technologies and changing business models.

The year ahead will be an exciting one as MSRB achieves the milestone of 50 years of serving the public interest. As we do so, MSRB’s Board and staff remain evermore dedicated to the mission of protecting and strengthening the market for the bonds that make America stronger. Please follow us on social media for updates.